by Adam Velas, Financial Systems Consultant, Excel Global Partners

Introduction

University Medical Center (UMC) is one of the top academic medical centers in the nation, pioneering education and research in the biomedical field. The university provides medical care for millions of patients a year and is responsible for many groundbreaking medical advances over the years. Behind the scenes of a terrific medical staff was another hard-working staff, accounting and finance team, whose work ensure the medical center continues to provide exceptional care to the community. One issue that needed to be fixed, however, was an inefficient and time-consuming close process that took hours/days away from critical analytics and required too many manual steps.

Circumstances and Challenges

UMC, like many other universities, is a complex organization that needs to report on a wide range of criteria. With complex reporting needs, comes more than a few challenges, especially for an institution or business that relies on excel or legacy CPM applications. A difficult challenge that the UMC had was the monthly and annual close requirements together with various time constraints including too many manual processes.

Being that UMC is a component of a very large higher education system, reporting is needed various dimensions for analytical purposes. Some of those reporting requirements are by funds, activity within funds, expenses by function and by class and by various projects. As an institution that provides health care, UMC reports on Medical/Physician group activity and as a hospital across the business activities both individually and as a part of the institution. This requires monthly and annual closing processes with intersecting activity to be approved and reviewed at various levels. Due to this complexity, the closing process had differing timelines instead of an efficient process that is driven by dependent activities and approvals for success.

As for the manual processes, reports would historically be derived from extracted data that required several hours of manipulation and compiling. With this being done for not one, but several different reports, the susceptibility of error was very high. These processes are not an efficient use of time and personnel resources. A solution was needed to automate and remove the user error from reporting and closing entries so that extra time could be spent on analytics to drive the institution’s success. This would also provide the benefit of a clear audit trail with standardized processes.

CPM Selection Process

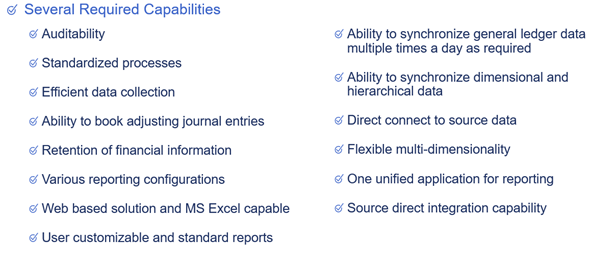

When looking for a CPM, there were several requirements that were needed by UMC. The list below included items that were critical to the institution’s success.

The solution needed to be easily deployable, compatible with excel for analysis, and have the ability for highly customizable and complex reports. With these requirements comes the need for the CPM to also be able to handle different flows and approvals for separate entities. With the current pain points and software requirements, OneStream was seen as the best solution for UMC.

The reason UMC selected OneStream as their solution encompasses many key advantages of the software. OneStream Intelligent Finance Platform allows you to break away from the limitations of spreadsheets and legacy applications. It unifies financial consolidation, planning, reporting and analysis through a single, extensible platform. It significantly reduces budget formulation, financial close, and financial reporting cycle times. Budget Book Creation and Annual Financial Reports (AFR) can be created in weeks, not months. You can evolve your processes from the limitations of manual spreadsheets to dynamic, calculated, automated results. With OneStream you can easily run what-if scenarios on spend management and more. It will support your need for Long-Term Tuition Planning, People Planning and Capital Planning as part of your overarching budget process. OneStream supports organizations in the ability to analyze data quickly and accurately to meet the challenges of current trends while spending less time massaging data.

CPM Implementation Process

At EGP our Implementation Process is more of an agile approach with an integrated iterative process and we believe good communication is the key to change management. The implementation process for UMC followed how EGP always recommends implementations, using five key steps (Design, Build, Testing, Training, Go Live) and utilizing EGP PM2.

At EGP we believe the Design phase at the very beginning of a project is a very critical step in the implementation process. With a comprehensive design and review, this ensures that the project is proceeding in the correct direction from the very start while also taking into consideration future needs of the business. It is critical when implementing to ensure that additional functionality of the application that might be needed down the road (Account Rec, Budgeting/Forecasting) is not built out when implementing Consolidations and Reporting now, for example. For UMC, EGP and OneStream met several times and held long detailed meetings to cover all the bases needed for a successful implementation.

During our engagement with our clients, we work to ensure these critical aspects of a software implementation are being addressed. One facet we find crucial to not only a successful implementation but also an absorption into the company and full use of the solution is Cultural acceptance. During our time working with our clients, we stay tuned into this phase and work to help the adoption of the software. This can be managed and supported by doing a few things; onsite champion, open communication, listening to the users, and working closely with the teams to help transition the use of the software.

Training is another critical aspect of the implementation process. By having a thorough handoff and knowledge transfer with a train the trainer approach, this helps with user and cultural acceptance of a new application and provides a pride of ownership to new users. We find this very critical especially if this is the first phase of OneStream being implemented, as this becomes easier when adding to an existing application rather than implementing fresh.

OneStream Benefits

OneStream provided several benefits to UMC. There is now a level of transparency and reporting capabilities that were impossible before and now they can also automate processes that were time consuming and prone to error.

The transparency of implementing OneStream allows a clear audit trail between the various reporting requirements. Knowing where items were adjusted and why is a huge improvement. Allocation journals provide a systematic support for recurring driver-based transactions and they also are able to now see forecast projections with the adjustment layered on top to see the development of the projections.

Automation can now be used for close entries to allow quick insight to financial information and different sources. This includes transactions in the reporting system that are held at parent level that isn’t on ledgers. Closing rules and equity by funds now run every month rather than once a year and allow for optimal financial analysis. Allocation journals are now accessible to the entire team rather than one person and were automated and calculate in minutes rather than the process taking hours before hand.

Conclusion

After choosing and implementing OneStream, UMC is now able to allocate resources where they are needed and not have to worry about the inefficiency and potential inaccuracy in reporting. Compilation of reports are now automated and exist is one location that is quick and easy to update and rerun, leading to efficient analysis. Within the old process of excel, these reports were in multiple locations, took hours to compile, and were difficult and complex to make changes and do analysis. Industry leaders are choosing OneStream because of the simple and intuitive interfaces that allow all your financial information to exist in one application. Having multiple applications for FP&A, Consolidations, Account Reconciliation, etc. is no longer needed and cuts down on cost and personnel hours that are inefficient in the workplace. As OneStream continues to grow, new updates and features are continuously added and provide businesses with a new and complete way to run and analyze their financials.