This article was originally published on OneStream.com by John O’Rourke

Leading at Speed Starts with Conquering Complexity

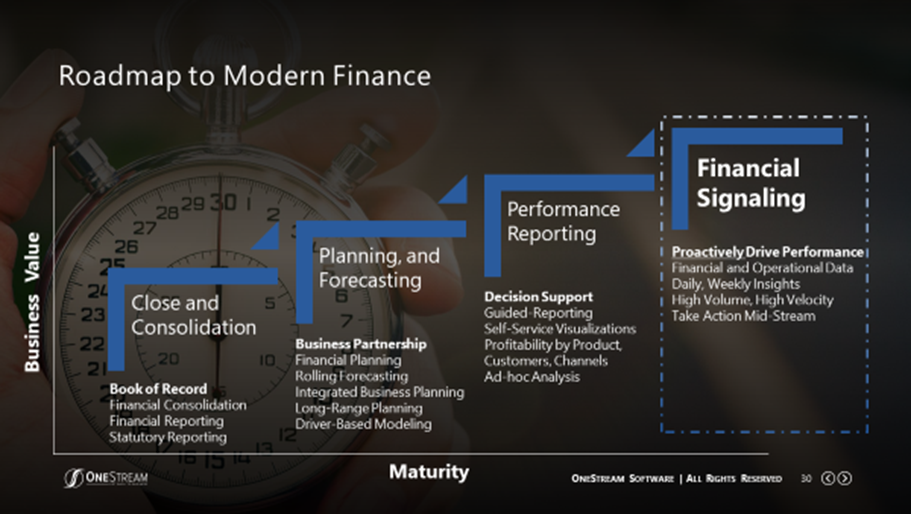

In October of 2020, I published a blog post titled “Finance in the 2020s – How to Conquer Complexity and Lead at Speed.” In that article, I described a Modern Finance Maturity Model that provided a roadmap to conquering the complexity of critical finance processes and enabling CFOs and Finance teams to operate with more agility.

The key message was that Finance executives and teams need to master the basic finance processes, then layer on more advanced capabilities that can drive digital transformation. (see figure 1)

Mastering the basic finance processes includes streamlining and simplifying book of record financial reporting and implementing agile planning and forecasting. With these processes running efficiently, Finance teams can then support strategic decision-making across the enterprise through period-end performance reporting, then move into the more advanced process of financial signaling.

Sounds simple right? Not really. There’s a lot of work that is required, but it doesn’t have to all be accomplished in one fell swoop. The best path to success is to think big — but start small and incrementally build a path to leading at speed through the adoption of modern, digital technologies.

6 Steps to Leading at Speed

Here are six steps successful finance organizations are taking to conquer complexity and put themselves in a position to lead at speed. The order of the steps described here is not carved in stone, it can vary depending on the challenges and requirements of a particular organization. The 6 steps include the following:

- Drive Simplicity and Efficiency in IT Systems

- Implement a Fast and Accurate Financial Close Process

- Align Strategic, Financial, and Operational Planning

- Empower Managers with Financial and Operational Data and Metrics

- Leverage Advanced Analytics Such as Predictive Forecasting Artificial Intelligence, and Machine Learning

- Ensure Internal Systems and Processes are Poised to Support Growth and Expansion

These steps are described in more detail in a white paper titled: “6 Steps to Leading at Speed”, which you can download here. In summary, in order to lead at speed, organizations need efficiency in IT systems, agile business processes, and the ability to deliver timely and accurate financial and operational results to executives and decision-makers across the enterprise.

This can only be accomplished with a unified, CPM software platform that can conquer the complexity of these finance processes and enable CFOs and finance teams to lead at speed.

Leading at Speed in Action

As mentioned above, the order of the steps described here isn’t carved in stone, nor should an organization try to accomplish all of these steps at one time. Where a particular organization decides to focus its efforts should be driven by business needs and priorities. But as the organization accomplishes these steps, the business benefits will begin to accumulate.

OneStream has worked with hundreds of organizations to help Finance teams conquer the complexity of their finance processes, unleash the value of their finance teams, and empower the enterprise with financial and operational insights. Download the “6 Steps to Leading at Speed” white paper to learn how these organizations have simplified their IT landscapes and reduced TCO for Finance applications. You can also learn how they increased Finance team productivity, shifted more time to partner with a line of business leaders, and increased their business agility. Now that’s leading at speed!