This article first appeared on CFO.com by Adam Zaki

As the consensus of economic trouble en route for 2023 grows, finance executives are compiling different strategies to prepare to do business in a new economic landscape. CFOs have a full plate of challenges in the upcoming year, including supply chain woes, ESG policies, adjusting their tactics in a stiff labor market, and continuing to research and invest in new technologies.

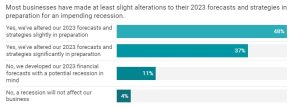

New data from OneStream’s Decision Maker Outlook survey of over 650 finance executives in North America and Europe conducted by Hanover Research, found, 5% of financial leaders are re-forecasting in preparation for an impending recession. Only 4% of executives said a recession will not affect their business in 2023.

Planning for Post-Recession

“CFOs ultimately need to drive long-term shareholder value,” Bill Koefoed, CFO of OneStream, told CFO. He spoke about how finance executives need to be prepared, but the key to preparation is forecasting beyond an economic downturn. Planning for post-recession with proper allocations is a major component of a company’s chance of balancing recession preparation and growth, he said.

“Organizations that prepare to successfully navigate a recession can better position themselves for future growth,” Koefoed said. “It was shown in the 2008 recession that those organizations that kept investing were more prepared for growth as the economy recovered.”

Survey findings reveal that 93% of financial executives believe inflation will remain elevated in 2023. FP&A duties may increase, as prices rise simultaneously with the value of cash reserves dropping. For a business that is late to the game, Koefoed stressed the importance of agility in preparation. According to both data and the OneStream CFO, executives who continue to lag behind and operate off of the status quo are putting themselves in a tough spot come mid to late 2023.

Has Your Company Revisited Financial Forecasts and Investment Plans for the Coming Year?

Most businesses have made at least slight alterations to their 2023 forecasts and strategies in preparation for an impending recession.

“Executives must put one foot on the accelerator and one foot on the brake,” said Koefoed. “If you need to hit the brakes, then hit them. But leaders must keep an eye out on what’s ahead to balance profitability and growth,” he said. “Organizations need to leverage data from across the enterprise to drive efficiencies and position themselves for success.”

Data shows finance leaders are not expecting an economic break until late 2023. Seventy-five percent expect ongoing economic and supply chain challenges to last into mid-to-late 2023 or further, with another 72% expecting inflation won’t recede until around the same time. In response to these forecasts, over half of respondents (56%) said they plan on increasing prices while another 47% report slowing hiring or reducing operational costs. Thirty-nine percent of those surveyed also reported plans to renegotiate contracts with suppliers.

ESG Ratings and Disclosures and Strategizing for DEI

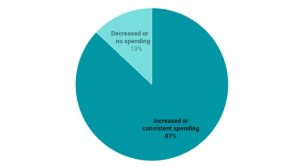

As the SEC announced ESG and climate-related disclosures on the horizon, executives are responding to increased stakeholder interest in the matter by investing in ESG-related areas to better prepare their organizations for incoming changes to disclosure policies. The data shows 87% of organizations plan to invest consistently or more in ESG for their business in 2023. Few respondents said they would decrease or eliminate ESG spending.

Corporate ESG Investment Plans in 2023

A majority of organizations plan to invest consistently or more in ESG for their businesses.

According to Koefoed, mastering the balance between ESG investments in recession preparation comes down to properly assessing value. “Leaders need to invest in ESG requirements while simultaneously preparing for a recession by balancing their investments in driving shareholder value,” he said.

Integrating their staff through diversity, equity, and inclusion (DEI) policies is a focus for executives as they build their workforce. Data found that over half (58%) of financial executives and decision-makers believe a gender pay gap is an issue for recruiting women into finance roles. Eighty-five percent of respondents said they will maintain or increase their current spending on DEI initiatives going into the new year.

Is AutoML Replacing Machine Learning?

With technology becoming a significant component of how finance teams do their day-to-day work — and may even have a direct impact on their employee’s morale — finance executives and their teams are putting a heavy emphasis on this type of integration into their business. With just 37% of those surveyed reporting that integration of machine learning is a part of their business plan, significantly below recent predictions, underutilization of these types of products may be the reason why they are some of the first things to be trimmed in budget cuts.

“The data indicates machine learning investment is down, which may be accredited to underutilization and misplaced anxieties around onboarding this type of technology,” Koefoed said. “As we’re approaching a possible recession, it’s understandable that leaders are concerned about the added time it will take their teams to become comfortable with new processes.”

While machine learning may be down, auto machine learning, or AutoML, is on the uptick. As a machine-learning-based tool that provides the benefits of machine learning without the tech expertise to leverage its maximum value, data found over a quarter (28%) of companies surveyed have already adopted AutoML solutions. Although upfront costs for this type of technology can be high, close to half (48%) of organizations will continue investigating whether or not to invest in AutoML.

“AutoML offers more flexibility for users who are not machine learning experts but still want access to highly effective and clean data models to drive accurate insights,” said Koefoed.

Executives Want Problem-Solving, Strategically Thinking Communicators

As the labor market continues to struggle post-pandemic, executives seem to be looking for the same types of characteristics in their ideal employees. Despite a push to invest in technology, the top-desired traits for new employees aren’t ones who are tech connoisseurs or software experts. Executives reported desiring skill sets like problem-solving/decision-making abilities (68%), strategic/business-oriented thinking (67%), and communication skills (53%).

What Skills Are Considered Most Valuable in a Financial Leader and/or Team?

Problem-solving/decision-making and strategic/business-oriented thinking are considered the most valuable skills for financial leaders.

Less than half of those (43%) surveyed said they are looking for those who are well-versed in technology solutions. Barely a third (34%) reported being interested in a candidate who has strong time management skills.