This article first appeared on OneStreamsoftware.com by Zach McKeown

This past year has undoubtedly been challenging for all organizations, regardless of their size and structure, given the impacts of ongoing global events. But the trajectory of a once-stable path has created an opportunity to rethink a better, more promising path. As organizations ramp up for 2023, Finance teams must take time to not only reflect on the past 12 months but also look ahead and determine what actions taken today will help the organization power through the uncertainty ahead. That path should be one where agile rolling forecasts and continuous collaboration help improve Financial Planning & Analysis (FP&A) processes and performance.

Missing Collaboration Opportunities

Today’s Finance leaders have more organizational influence than ever. And with an abundance of technological innovations at their disposal, Finance can continue shift its focus from back-office activities to delivering insights across the enterprise. Many of the same leaders, however, are not putting the same emphasis on measuring and improving collaboration across the enterprise. Why? Well, while silos of point solutions solve for individual processes – because they are typically not unified, – they can actually lead to misaligned forecasting processes which crushes collaboration opportunities.

Where’s the proof? To start, there are all the times over the past year that Finance teams had to chase down monthly forecast files from Sales, HR, Supply Chain, etc. – only to discover the provided files are incomplete or have some anomalies that require follow-up. After all, most organizations strive for the following:

- To understand how internal and external forces impact performance management, Finance data must be integrated with data from different functions (e.g., Sales, Demand, Supply Chain, etc.).

- To enable better decision-making, agility, and speed, rolling forecasts must get done in a timely manner, without compromising accuracy.

- For effective collaboration, the flexibility of a single unified intelligent platform is critical to unifying the forecasting function with data and processes across the organization.

2022 Challenges Hamper Organizational Planning

The acceleration of FP&A as a profession has changed dramatically over the past 12 months – transforming the function into a true business partner focused team. That evolution has been shaped by prevailing business conditions and the corresponding challenges presented to management.

In the past, FP&A primarily focused on historical analyses to provide business insights – playing a passive support role in planning and decision support. But today’s uncertain business climate where radical change can happen in a matter of weeks makes this approach far from adequate.

To thrive in today’s complex economy, sophisticated organizations face tremendous pressure to evolve with the changes and do so at speed. Yet unforeseen events (e.g., global inflation) can render past trends obsolete and modify the way teams work across the organization. Similarly, supporting a planning regime that cannot cope with the complexity of fast-changing markets is also futile.

Not to mention, normal annual challenges only get amplified with the introduction of new global disruptions. The time to think about New Year’s Resolutions is therefore right now given that many Finance leaders feel the pressure of the below challenges:

- Long working hours while Finance staff chase down anomalies

- Lack of continuous on-demand planning and forecasting

- Need for data inconsistencies and constant data validation across data models

- Fragmented systems and tools

- Outdated planning, budgeting, and forecast processes

- Lack of flexible Finance systems

- Out-of-cycle downward budget adjustments

Such challenges don’t need to continue derailing FP&A practices year after year.

The New Year Offers a Restart with Practical and Simple Solutions

Today, Finance chiefs are challenged with helping their organizations break the reliance on annual plans and embracing more accurate, agile, and collaborative planning techniques. Those techniques include driver-based planning and rolling forecasts, and three resolutions can help Finance teams ensure a successful restart in the new year:

- Focus on continuous planning to accelerate agility

- Remove manual processes that erode data accuracy and trust

- Engage Finance and Operational Planning teams to drive collaboration

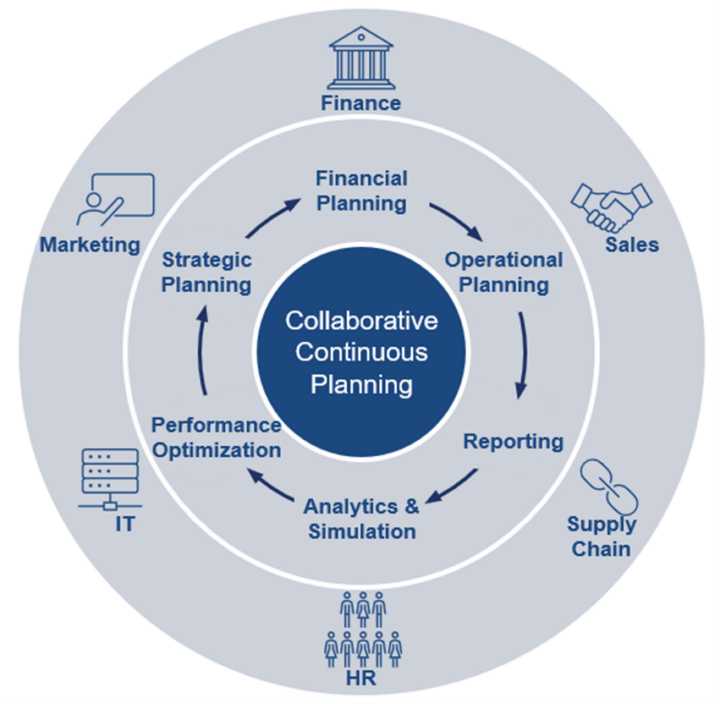

In recent years, Finance leaders have taken on several major strategic initiatives to prepare for an ever-evolving landscape. Those initiatives include replacing detailed annual planning cycles – which take too long and result in an out-of-date budget as soon as it’s complete. With continuous planning, however, Finance is more effective due to focusing on rolling views that look 12 to 18 months ahead. How? Continuous plans enable managers to respond more rapidly to emerging events and trends and to changing business environments while increasing higher levels of corporate collaboration (see Figure 1).

In fact, collaboration is forever joined to continuous planning – fostering agility and enabling a more accurate and updated response to economic pressures that traditional forecasts simply can’t offer. And a strategic dialogue focused on driving performance. That agility is important in a planning world more complex than ever, and if FP&A is to continue being a valued business partner, its role and approach must change.

Empowering FP&A Empowers the Organization

The past few years have shown that existing systems, processes and ways of working are not agile enough to deliver the greater demand for data, insights, scenarios, forecasts and plans. In short, the old ways of working and organizing simply aren’t strong enough to create and maintain the collaborative bond needed for accurate and trusted planning, budgeting, and forecasting.

But continuous planning empowers the organization in several key ways, among others:

- Aligning operationally relevant plans and actuals with financial goals

- Creating granular driver-based plans at the person, customer and/or product level

- Conquering the complexity of creating predictive and machine-learning models without data science expertise

- Quickly creating various what-if scenarios without requiring a full bottom-up forecast

Conclusion

While 2022 had been challenging, Finance teams have the opportunity in 2023 to rethink a better, more promising path for organizational success. Finance is poised to lead organizational transformation by expanding continuous planning and increasing finance and operational collaboration across the enterprise. The right solution, like OneStream, makes it possible by enabling better access to data and better processes – all of which ultimately allow the annual plan to remain relevant in tracking business goals and objectives into the year, even as conditions constantly change.

Learn More

To learn more about how FP&A teams are moving to continuous rolling forecasts, click here to download the ebook titled “Unified Planning, Reporting & Analytics.”