Ultimately, IBP is the evolution of Sales & Operations Planning, which is a process deeply rooted into sales and supply chain operations. Many organizations therefore manage IBP from within Operations and avoid or disregard Finance participation. But that shouldn’t be the way. Why not? Well, IBP is not an operational process. When done right, IBP is a process to help the C-suite – particularly CEOs – to deploy strategy and make faster and better decisions. And because CEOs speak the financial language, IBP should be a Finance-led process.

With the above in mind, many organizations unsurprisingly fail to get the right level of sponsorship, and their IBP initiatives fail to deliver what they should. CEOs aren’t interested in partial or biased views of a plan. Instead, they expect IBP to help them compose a neutral view that drives business performance effectively. And that’s a succinct reason that CEOs will trust and support IBP.

How, then, can you get your CEO to trust the IBP process? This blog will dive into 5 considerations to help your CEO trust IBP.

5 Considerations to Help Your CEO Trust the IBP Process

Much has been written about the lack of executive support for IBP, but not much has been written about how an IBP initiative can win your CEO’s heart and mind. The following considerations can help:

- Anchor IBP to Finance metrics for P&L, Cashflow, and Return on Invested Capital. Finance metrics (e.g., EBIT or ROIC) make the IBP process effective. Therefore, organizations with mature IBP processes use key Finance metrics because they are the best value indicators and CEOs understand those metrics.

- Focus on the right time horizons. IBP is primarily a strategic planning process used to address long-term horizons (3-5 years). At the same time, it should also serve as a connector to the short-term plans and initiatives (1-2 years). Calibrating to the right time horizons is therefore a fantastic opportunity to connect IBP with the C-suite.

- Make it all-inclusive. IBP can include the Finance, Product, Demand, Supply and Support functions. Traditionally, S&OP connects Supply Chain with the Demand Generation and Sales teams. IBP expands to Finance and Product, but what about other functions that – for example – require workforce or CapEx planning? There’s no better presentation card than an all-inclusive IBP discipline to represent the holistic planning view of the organization that the CEO leads.

- Make IBP auditable and accountable. One of the main purposes of IBP is to foster collaboration and accountability. Thus, orchestrating and synchronizing becomes critical, and accountability must be well-defined at every step of the process. At the same time, data, numbers and assumptions must be auditable and traceable all the way up to financial statements and results. This capability will raise the CEO’s confidence in the numbers, insights and recommendations from the IBP team.

- Balance granularity versus insight. By focusing on the daily operational details, organizations can miss the bigger picture and fail to provide the appropriate insights for the leadership team. Given that, is it necessary to drill down to the part-number level? Does IBP really require daily information?

From Integrated Business Planning to Improved Business Performance

If you’ve reached this point in the post, you might be thinking that the five considerations above make sense. They aren’t trivial, however. In fact, they can be hard to achieve. How, then, do you get there?

IBP is ultimately about deploying the company strategy through structured and cohesive planning across the organization. And the considerations outlined in this post are difficult to achieve without the proper technology solution.

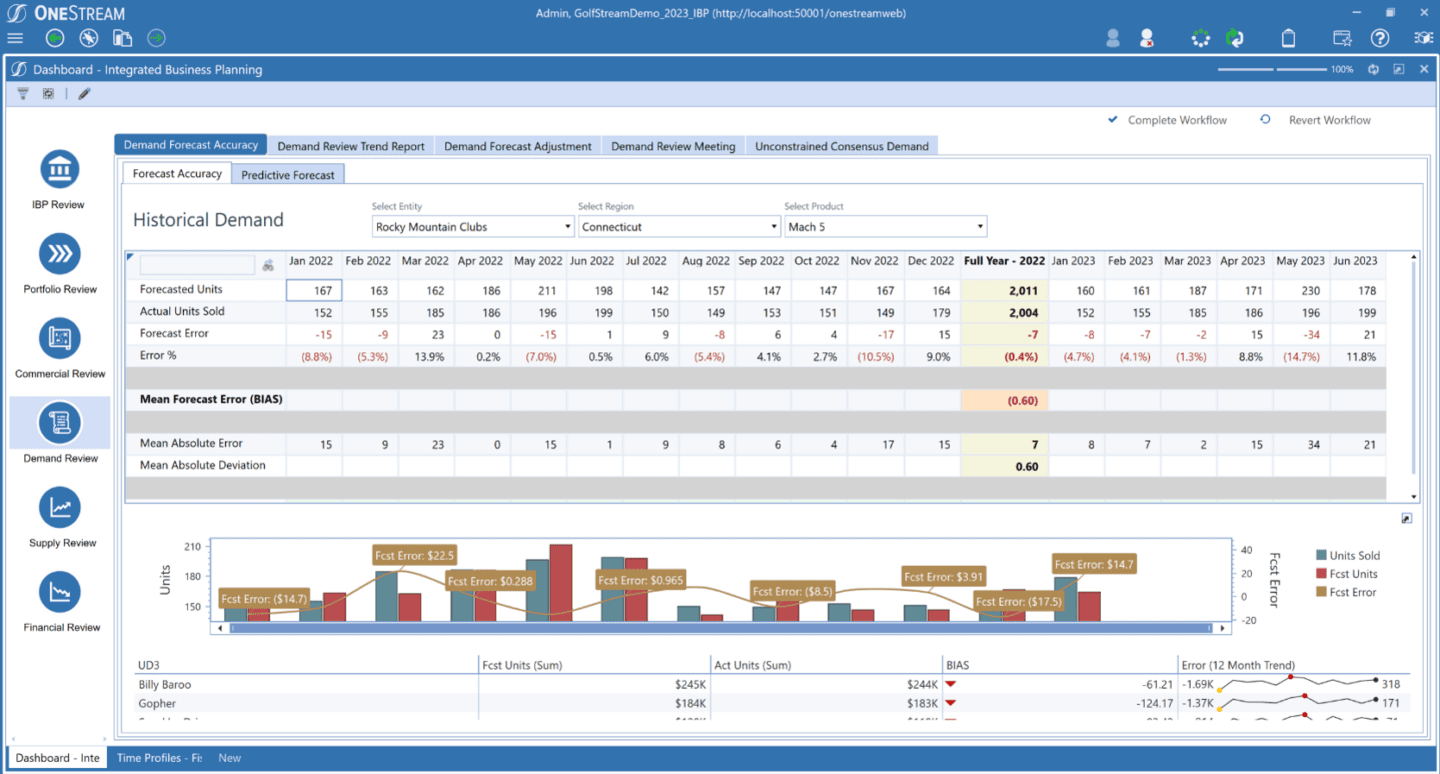

Often, technology during IBP implementations focuses only on reporting and visualization capabilities, disregarding other key capabilities. For instance, the capabilities below might be disregarded:

- Data management automation

- Data cohesiveness (one set of numbers)

- Data integrity and pedigree (anchored to financial metrics and artifacts)

- Adaptive and intuitive process workflows and approvals (auditable collaboration)

- Calibration between insights and detail

When the technology covers all these aspects, Integrated Business Planning becomes the right framework to improve business performance.

And unequivocally, modern EPM solutions are the best choice to bring all these capabilities together and establish an IBP process that serves a purpose for the CEO and C-suite.

All Things Considered…

IBP done right is ultimately a Finance-driven process. And OneStream’s Finance Platform is the only market solution capable of providing every single mission-critical process for Finance. Need proof? Look no further than Autoliv, a world-leading supplier in safety systems. Autoliv used OneStream and its unified data model approach to transform financial and operational planning to respond to market changes and make faster decisions.

In other words, the unified data model, data management and quality, financial intelligence, automation and analytical AI services in OneStream make it uniquely positioned to win your CEO’s heart and mind.

Learn More

Want to learn how you can maximize the benefits of your IBP process and get your CEO onboard, read our article on how to unify IBP and maximize the benefits.

This article first appeared on OneStream Software blog page by Jaime Marijuán Castro