This article first appeared on Dataversity.net by Whitney Gillespie

For Financial Planning and Analysis (FP&A) practitioners, incorporating more operational inputs into the planning process has become critical to driving performance. This shift from traditional FP&A methods elevates the practice to an eXtended Planning and Analysis (xP&A) process. How can Finance accomplish this shift? One key way is by incorporating the demand plan from the Sales and Operations Planning (S&OP) process into financial planning. Leveraging a unified FP&A software platform helps enable Intelligent Demand Planning – and with that comes improved forecast accuracy, better financial decisions and more impactful results.

Siloed Financial Planning Is No Longer an Option

Global supply chain disruptions. Labor shortages. Raw materials with limited availability. Collectively, these supply-side problems underscore why Finance must understand the operational business drivers that impact demand planning. And now more than ever, Finance must also be able to incorporate those drivers into the financial planning process. Why? Because understanding the financial implications of the demand plan informs organizational decision-making to maximize efficiencies and ultimately drive profits while minimizing losses.

One key to elevating FP&A to xP&A is utilizing the demand plan from the S&OP process. The operational inputs from the plan should be added to the financial planning process, which itself must remain dynamic. The pace of change, after all, only continues to increase – making it vital to keep financial planning responsive to change. What was relevant when the plan was developed will likely change as the plan is executed. Having an effective FP&A software solution allows users to access, visualize and update the plan and key metrics as change occurs.

In other words, siloed planning is no longer an option.

Leverage Modern Software to Enable Intelligent Demand Planning

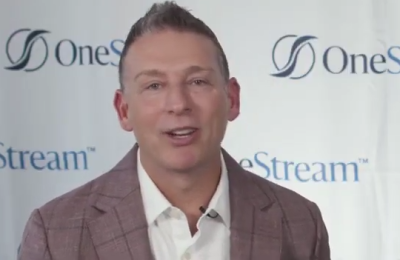

Modern corporate performance management (CPM) software enables Intelligent Demand Planning (see Figure 1). How? By continually assessing on-target forecast trends and adjusting based on changes in marketplace conditions (e.g., labor shortages or rising material costs). Top performing organizations seek to unify planning activities with financial forecasts and plans using Intelligent Demand Planning to do the following:

- Develop multiple scenarios on the fly, and model plans using business drivers.

- Create daily and weekly operational signaling for rapid response decision-making.

- Turn financial signals and trends in the data into actionable insights.

- Get full transparency, auditability and drill-down to transaction details.

These capabilities and others make demand planning easier, quicker and more accurate than ever. Plus, these operational improvements reduce organizational risks and have direct financial implications.

Figure 1: OneStream Intelligent Demand Planning Capabilities

Forecast More Accurately with Intelligent Demand Planning

Intelligent Demand Planning enables better demand forecast accuracy, which produces results that significantly impact financial performance. Why? With accurate demand plans, organizations can optimize their inventory management and reduce unnecessary on-hand inventory. Those changes lead to lower inventory holding costs, fewer obsolescence issues, and less scrap and waste. The demand planning process also analyzes customer purchasing habits and demand, helping to improve inventory management.

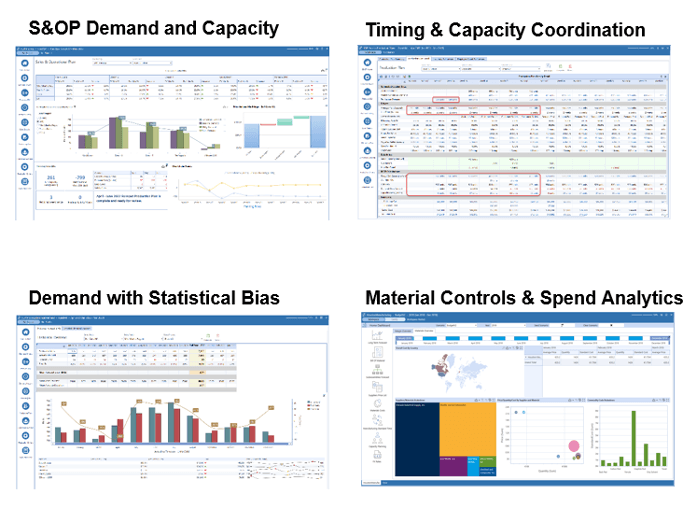

Improved inventory management helps Finance achieve three key benefits (see Figure 2):

- Increase working capital and profit by optimizing inventory and enabling just-in-time manufacturing to reduce inventory holding costs from over-forecasting.

- Mitigate lost sales and revenue from under-forecasting by ensuring products are in the right place at the right time to meet customer demand and avoid obsolescence issues.

- Reduce lost profit by eliminating rushed orders for higher-priced materials due to under-forecasting and inaccurately assessing demand.

5 Key Factors for Effective xP&A

When preparing to take advantage of xP&A to drive performance across the organization, FP&A leaders should evaluate options based on 5 key components and their benefits:

- A Unified, Extensible Platform – Alignment of granular operational plans with financial forecasting and performance through a unified, extensible platform and data model.

- Built-In Financial Data Quality – High-quality and accurate management reporting that empowers Finance teams and their business partners to develop insights and guide key decisions that drive performance.

- Built-In Financial Intelligence – Faster implementation process that reduces costs and ensures the accuracy of the results produced by the solution.

- Financial Signaling – Eliminated reliance on the month-end reporting cycle by accessing and leveraging abundant daily and weekly operational insights across the organization.

- Auto Artificial Intelligence (AI) – Increased time to value for machine learning forecasting with built-in auto AI capabilities to increase forecasting accuracy and enable continuous scenario modeling amid increasing complexity and fast-paced change.

Customers Leading the Way

John B. Sanfilippo & Son, Inc (JBSS) processes and distributes tree nuts, peanuts and nut products through distribution channels in the United States and around the world. JBSS is a major processor and distributor of snack and recipe nut products, offering raw and processed nuts in various styles and seasonings. The company’s nut and dried fruit-based products are sold under a variety of private brands, including Fisher®, Orchard Valley Harvest®, Squirrel Brand®, Southern Style Nuts® and Sunshine Country®.

The company was founded by Gaspare Sanfilippo and John B. Sanfilippo in 1922 and is headquartered in Elgin, IL. Today, JBSS operates with around 1,200 employees across four plants: JBSS headquarters in Illinois, peanut sheller in Georgia, pecan sheller in Texas and walnut sheller in California

After using SAP BPC for its internal sales reporting, financial reporting, and forecasting for numerous years, JBSS felt stuck as its legacy CPM solution wasn’t fueling innovation as the company attempted to evolve. The Finance team was jumping through hoops because the legacy CPM solution couldn’t handle their unique reporting needs, which included information at the base level and across multiple hierarchies where data expanded. It was difficult to make top-down adjustments, and too much time was spent on manual data manipulation.

With OneStream’s unified CPM software, JBSS now has one system for actuals, budgets, quarterly forecasts, weekly operations data and demand analysis. Additionally, JBSS can now get the latest costs, volumes and expenses that help reforecast the annual budget and provide executives with visibility to change or shift data as needed. The Financial Planning team has gone from maintaining 30 Excel templates to 1 master template in OneStream while shortening the forecast process from 2 weeks to 2 days.

Conclusion

In sum, Finance must evolve the value of the Financial Planning & Analysis process to take the organization to the next level with xP&A. That evolution requires integrating operational inputs from S&OP into the financial planning process. One key output of the S&OP process is the demand plan and using Intelligent Demand Planning as part of effective FP&A software improves forecast accuracy to ultimately drive better financial performance.

Learn More

Want to learn more about how your organization can take steps toward evolving the value of forecasting into xP&A? Click here to download our ebook on Intelligent Forecasting.