This article first appeared on the OneStream blog by Tiffany Ma

In the world of corporate performance management (CPM), organizations are constantly looking for ways to improve financial planning and analysis (FP&A) processes. And in recent years, one growing trend focuses on incorporating machine learning (ML) and artificial intelligence (AI) into CPM solutions to enhance efficiency and accuracy. Why? Well, ML can help Finance teams make more accurate and reliable forecasts, automate repetitive tasks, and identify patterns and trends that might otherwise go unnoticed in traditional analysis.

Artificial Intelligence – From Hype to Reality

Unfortunately, AI has long been surrounded by hype, false starts and disappointing results. But the business community has finally started to see the advantageous outcomes of AI materializing. How? Three trends are making ML forecasting easy for FP&A teams.

Trend 1: AI plays an increasing role in FP&A

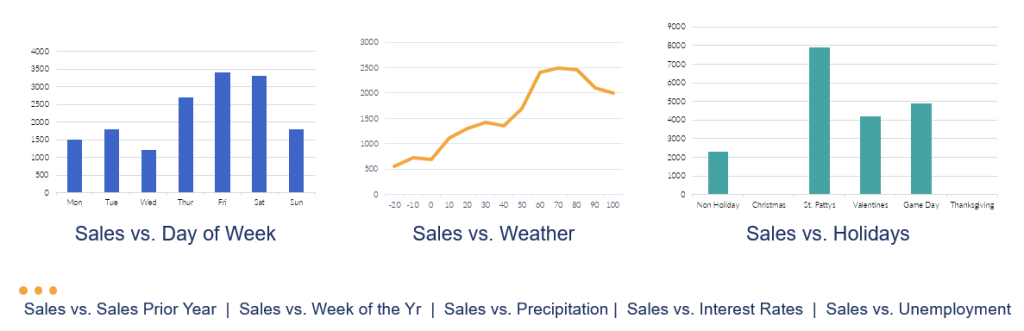

Many sophisticated organizations are still using traditional processes to produce forecasts. Specifically, those organizations take the previous year’s numbers, apply a blanketed percentage to them and complete the forecast with a few one-off adjustments. This process is something I like to call “a finger in the air” approach. Why? Well, incorporating all the drivers that might impact predictions is far too complex and time-consuming. Despite the ability to manage two dimensions (e.g., sales based on day of the week or sales based on the weather), humans can sometimes struggle with more complex scenarios with numerous variables (see Figure 1).

When incorporating additional drivers that impact sales, such as holidays, prior year sales, unemployment, etc., humans struggle to simultaneously process all these variables. Therefore, the default method to forecast is to use the aforementioned traditional method – taking last year’s numbers and making a few adjustments. In other words, making a high-level estimate without factoring in critical drivers influencing the forecast, hence the term “a finger in the air.”

How can ML solve the above limitation? ML can be particularly helpful in such situations. Specifically, it can learn and identify complex interactions and non-linear relationships between variables to provide more accurate and reliable forecasts. By leveraging ML’s ability to process multiple dimensions, organizations can gain deeper insights into operations and make more informed decisions. In addition, by aiding in the recognition of patterns and trends that may have been overlooked in traditional analysis, ML can facilitate more accurate forecasting.

AI therefore has the potential to revolutionize FP&A. With the help of AI-powered tools, Finance teams can reduce errors and save time by automating repetitive tasks (e.g., data collection, reconciliation and report generation).

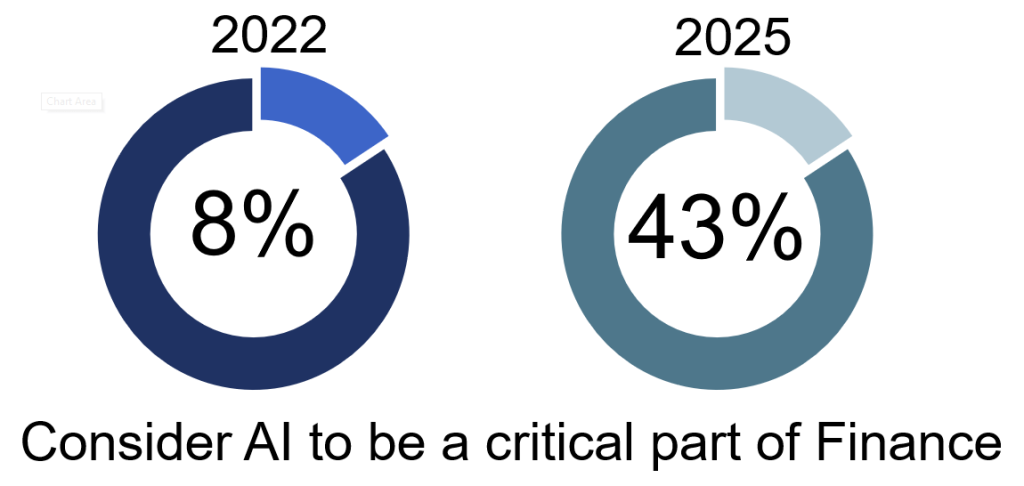

A study conducted by MIT[1] found that the number of executives who felt AI was a critical part of the Finance function would increase from 8% to 43% in only 3 years (see Figure 2).

In today’s data-driven business landscape with rapidly increasing data volumes, companies must remain agile to stay competitive. ML provides the tools to effectively process and make sense of vast amounts of data. With ML, businesses can stay ahead of the curve in a constantly evolving environment. FP&A must therefore embrace ML to remain competitive, effectively manage data and gain a strategic advantage.

Trend 2: Demand grows for pre-configured FP&A models

As the demand for efficient and accurate financial analysis grows, more organizations are turning to pre-configured FP&A models to expedite the process and reduce costs. These models offer organizations the ability to analyze financial data quickly and easily without needing to create a custom solution from scratch.

How? When ML is democratized to a broader group outside data scientists, business analysts can create, consume and maintain models without relying solely on the Data Science team. Many more business analysts than data scientists are available today. And as a result, organizations can now have several users capitalize on Auto ML capabilities to process large volumes of data and create hundreds or thousands of forecasts – at scale and at any level of granularity. Business analysts can then trust the models built and be strategic business partners who confidently drive financial and operational results within the business.

With the increasing demand for real-time insights and quick, informed decision-making, democratized ML within FP&A models is quickly becoming a popular choice for organizations seeking to improve their financial plans.

Trend 3: Strategic simulations become a business-critical activity

The business environment has become increasingly complex, so strategic simulations have become a crucial tool for businesses to understand the potential outcomes of different scenarios. By running simulations, businesses can evaluate how different decisions impact financial performance and then identify the best course of action.

And with packaged Auto ML capabilities built directly into the CPM system, Finance teams can quickly generate multiple scenarios while flexing various drivers. This quick, iterative process allows Finance to identify risks and opportunities, improve cross-functional collaboration, and increase forecast accuracy to drive better and faster strategic decision-making.

OneStream’s Sensible Machine Learning addresses all three trends mentioned above in a single, unified CPM solution.

Introducing Sensible ML

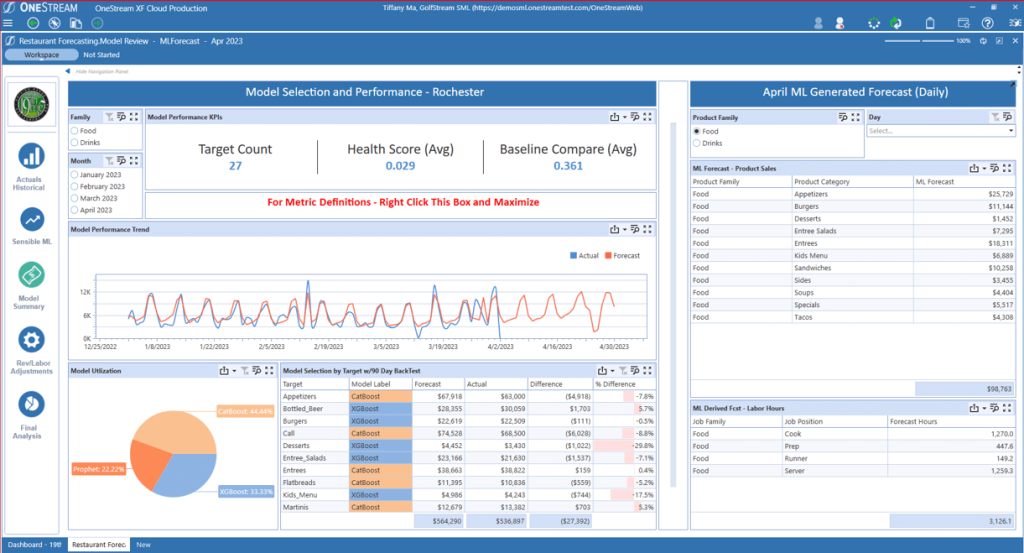

Sensible ML is OneStream’s Auto ML forecasting solution and includes the first and only time series ML capability built inside of CPM. Auto ML encapsulates the full data pipeline inside CPM, from data ingestion and quality, feature generation, and model building all the way through to dashboard analytics – all in a single platform.

As a result, OneStream’s Sensible ML not only simplifies ML processes to make more data and insights accessible to Finance and Operations teams, but also means much faster forecast iterations than would otherwise be possible (see Figure 3).

In sum, ML is transforming the CPM landscape by improving budgeting cycles and reinventing the role of the Office of Finance – and this transformation is just the beginning.

Conclusion

Today, productized ML is necessary for businesses to gain a competitive advantage in a constantly evolving environment. And as the world becomes more data-driven, the demand for efficient and accurate forecasts will only continue to grow. An Auto ML forecasting solution that encapsulates the full data pipeline inside of CPM is therefore becoming a popular choice for organizations. The need to create forecasts in a timely, efficient way at scale is paramount for organizations to effectively stay ahead of the competition.

Learn More

Sensible ML within OneStream can act as a copilot in managing your organization, driving faster and more accurate decisions. To learn more about how OneStream’s unified Auto ML can benefit your organization, check out our Sensible Machine Learning for CPM White Paper.