This article first appeared on OneStream Software blog page by Jaime Marijuán Castro

Strategic workforce planning is crucial for business leaders today. Why? Because the labor market is facing unparalleled forces of change: demographic upheaval, talent scarcity, evolving employee preferences when choosing an employer, and the ubiquitous and growing presence of artificial intelligence.

Running strategic workforce planning together with Finance in one unified solution is a best practice that ensures people plans align with strategic and financial objectives.

In fact, unifying workforce planning with both strategic and financial planning sets up organizations to thrive under unsettled market dynamics.

Before effectively implementing strategic workforce planning, an organization needs to understand what it entails, why it’s so unique, and how Enterprise Performance Management (EPM) adds value to such planning. But where to start?

What Is Strategic Workforce Planning

Strategic workforce planning is a long-term planning approach to hiring the right people (not just about a set of skills and expertise) at the right time (to match the business needs) and in the right place. This effort should also be fully aligned to the strategic goals of the organization. A strategic workforce planning model is pictured in Figure 1.

Why Planning for People Is So Unique

In simple terms, an organization needs to manage the following 3 factors to meet strategic objectives:

- Cash

- Assets

- People

Cash is like the “wild card” in that it grants access to people and assets.

Assets are somewhat certain. For example, an organization can classify an “office building” by a set of common characteristics within any office building (e.g., square meters, location, open spaces, power, and HVAC equipment, etc.). And that’s it — the requirements when searching for an office space somewhat match easily with the characteristics of available space.

However, people can’t be tagged in a similar way. For example, an individual may prefer higher compensation versus better work-life balance. And at a later stage in life, that same individual may prefer the opposite. Some people also value the work environment and team spirit more than others. In essence, every person is a unique individual, so planning for people requires certain solid patterns to do it right. An employer may have well-defined requirements for a job type, but each candidate will respond differently to the compensation and benefits package available.

This uniqueness makes planning and managing the workforce a difficult job for recruiters and HR departments. In addition, day-to-day operations and challenges may divert the attention of HR leaders, who could then lose sight of the strategic goals of the company. Here’s where an EPM solution for people planning can help.

Finance Teams Enables Better People Planning

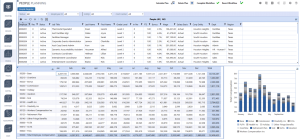

Finance teams can connect business strategy with HR planning. Why? Well, besides looking after the financial health of the company, Finance teams support leadership in shaping the strategy. They also have access to the best technology for strategic planning. Modern EPM solutions combine planning, consolidation and reporting capabilities all in a single solution. This includes a unified data model hosted in one platform that can also manage strategic workforce planning under the xP&A construct (Figure 2).

6 Ways EPM Helps With Strategic Workforce Planning

HR leaders should therefore partner with Finance teams when building the strategic workforce plan and use the same technology. Below are 6 ways a unified EPM solution can support strategic workforce planning:

- Aligns strategic planning with financial and workforce planning. All headcount and cost details live in one data model and are linked to the company’s strategic plan.

- Combines modeling capabilities. The plan is informed by modeling capabilities that use workforce data as drivers (salary, benefits, payroll, etc.) and links them with the financial model, including CapEx & cash forecasting, and along with strategic intent.

- Brings clarity in planning, budgeting and forecasting. HR leaders can generate positive impact on financial KPIs from modeling changes (new positions, promos, transfers, etc.) and perform driver-based changes (compensation, benefits by geography, etc.) in a matter of minutes.

- Facilitates agile decision-making. When the manpower budget and the total financial budget are unified, decisions are based on complete and always-available information. For example, to determine headcount needs, the fully burdened labor rates – which are composed of data from HR and disparate expense accounts – are applied to sales budgets and production capacity. When all this information is available within the same solution, leaders can plan and react quickly to unexpected events.

- Empowers HR leaders to align people plans with financial goals. HR leaders can better manage hire to retire processes and always know the financial impact. For example, overhead calculations (e.g., compensation and bonus) are automated by the system.

- Applies financial intelligence to workforce planning. The system can handle multi-currency and credit/debits automatically or perform mixed allocations (people, capital) and link them to cash flow planning, which saves analysts a ton of time.

Drawing It All Together

Today, strategic workforce planning is crucial amid uncertain market conditions. Yet strategic workforce planning shouldn’t be done alone. Why? Because it must lean on Finance teams to connect with strategy. Otherwise, organizations are left with just workforce planning, without the “strategic” piece.

An extensible EPM solution supports people planning and the financial model under the same data model– bringing significant advantages and business benefits to the table.

Bunge – a global leader in agribusiness, food and ingredients – uses the OneStream Intelligent Finance Platform to align people planning with strategy and performance. Want to hear more about how Bunge manages that alignment? Watch the webinar recording: