Understanding AI Basics in Finance

Efficiency Through Automation

AI in Finance is not about replacing human intelligence but enhancing it. The automation of repetitive and time-consuming tasks allows Finance professionals to focus on more strategic activities. For instance, AI-powered tools can automate planning, data entry and routine financial reporting – freeing up valuable time for analysis and decision-making.

Machine Learning for Predictive Analytics

AI enables Finance teams to move beyond historical reporting and embrace ML-backed predictive analytics. By analyzing historical data patterns, AI algorithms can more accurately forecast future trends. Those trends then help organizations make informed financial decisions. For example, AI can analyze customer behavior, purchase history and market trends to predict the ideal price point for each product or service. This personalized approach maximizes both revenue and customer satisfaction, paving the way for sustainable growth.

Exception Handling and Anomaly Detection for Streamlined Processes

AI’s ability to process vast amounts of data allows for the identification of patterns and anomalous data points. This ability facilitates exception handling for Finance processes such as planning, data quality and reporting. Thus, Finance professionals can streamline operations and focus on exceptions, rather than sifting through entire datasets. The approach ultimately saves valuable time and enhances the efficiency of financial processes.

As the Office of Finance continues to embrace AI, adopting a practical sensible approach to ML – one that balances automation with transparency and human insight – has become increasingly important. After all, effective planning is critical for businesses to remain competitive and adapt to changing market conditions.

At OneStream, we call this Sensible ML.

Introducing Sensible ML

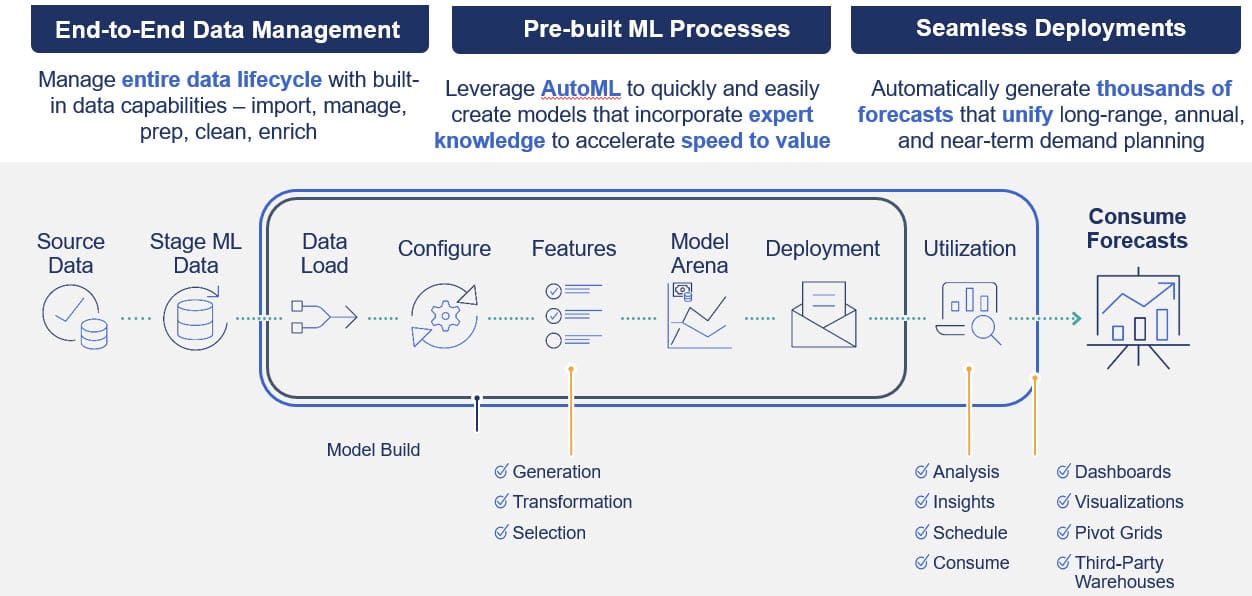

OneStream’s Sensible ML (see Figure 1) is a paradigm shift in leveraging AI for Finance professionals. By seamlessly unifying AI within an enterprise Finance platform, Sensible ML’s purpose-built for FP&A creates forecasts and insights that were previously impossible to do.

Figure 1: Sensible ML Process Flow

Purpose-Built AI for FP&A in a Unified Platform

By integrating AI, Finance teams can seamlessly leverage AI capabilities without the need for separate tools, systems or teams. No longer are the days of having data scientists create a forecast without understanding the business value and of the Finance team receiving the output with no understanding of where the numbers originated.

Instead, with purpose-built AI for Finance, FP&A teams are creating ML-backed forecasts on their own and for the entire process – from data ingestion and quality to model building, all the way to utilization and consumption. Finance professionals can now explain their accurate forecasts with confidence and do so at scale across hundreds or thousands of forecasts.

Sensible ML also incorporates external factors such as weather or macroeconomic factors to create highly accurate forecasts and utilizes a unique and groundbreaking concept, the Model Arena.

The Model Arena offers tailored precision by automatically selecting the most performant model for each forecasted line item. Contrast this approach to the one-size-fits-all approach that apply a single model for all forecasted line items, failing to account for the characteristics of each product-location combination. Comparatively, the Model Arena approach produces a much higher level of accuracy by accounting for the nuances of different forecasted products by locations.

For example, Polaris, a global leader in powersports whose products have vastly different characteristics, uses Sensible ML to forecasts for specific products and locations with distinct models across the business. Only a unique ML model tailored for their snowmobiles or off-road vehicles can create an accurate sales forecast – optimizing for downstream processes like allocation of resources or maximizing contribution margin.

Sensible ML’s Model Arena automatically selects the most accurate ML model for every product-location combination within differing business units. Ultimately, then, Sensible ML arms Finance professionals with deeper insights into future financial scenarios, enabling better decision-making and strategic planning.

Conclusion

As the Finance function continues to evolve, understanding the basics of AI is crucial for staying competitive and driving organizational success. OneStream’s Sensible ML empowers Finance professionals with purpose-built AI capabilities, making it a valuable tool in the quest for efficiency, accuracy and strategic decision-making. By embracing AI, Finance departments can position themselves at the forefront of innovation and contribute to the overall growth and success of their organizations.

Learn More

To learn more about how FP&A teams can learn AI basics in Finance, stay tuned for additional posts from our Sensible ML blog series or download our white paper here.

This article first appeared on OneStream Software blog page by Tiffany Ma