This article first appeared on the OneStream blog by Nicholas Cox

With an ever-increasing requirement from the financial markets to have better transparency into Environmental Social & Governance (ESG)/Sustainability initiatives, enterprises must collect, measure and publish non-financial information on ESG-related risks and opportunities to attract or retain investors. ESG goes beyond a simple collection exercise of new KPIs. In fact, much like the current external financial disclosures produced today, ESG reporting is becoming a key investment criterion. This criterion elevates the conversations from “just” reporting KPIs to instead developing an ESG investment strategy designed to respond to market expectations. For the past few years, OneStream Software has sponsored Hanover Research surveys of Finance executives to gain a better understanding of how they are helping their organizations navigate the complexities of today’s economic landscape. The Q4 2022 Hanover Research survey included over 650 financial decision-makers and aimed to understand their expectations for 2023 regarding inflation, a potential recession, supply chain disruptions, talent management, ESG and DEI initiatives, and technology investments. Keep reading to learn the results of the most recent survey on ESG initiatives.

ESG Initiatives Still in Focus

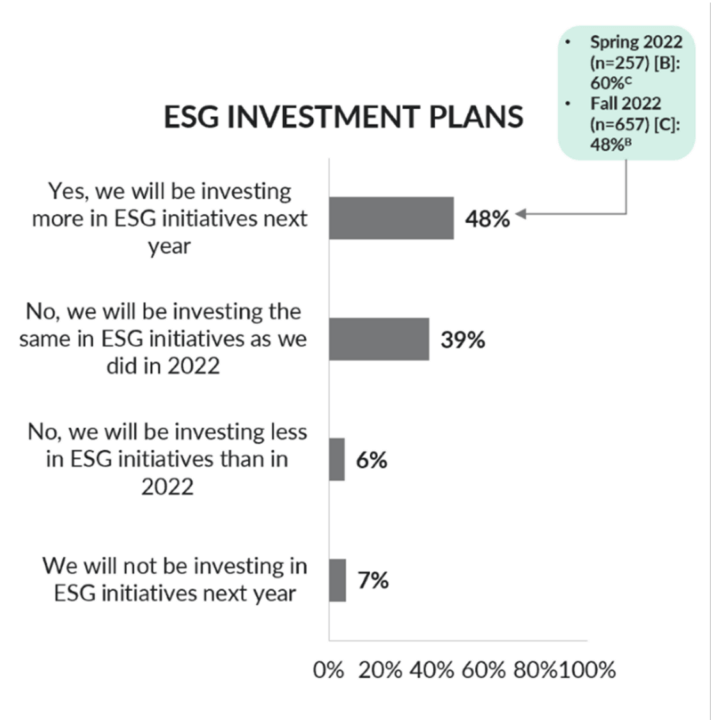

With ESG reporting guidelines converging and new mandatory disclosure requirements being proposed by the US SEC and regulators in other countries, investments in ESG remain a priority. Half of organizations surveyed expect to invest more in ESG goals and initiatives in 2023 than in 2022. The percentage is a slight drop compared to expectations from the Spring 2022 survey (60%). However, over a third of enterprises expect to invest the same amount in ESG in 2023 (39%) (see Figure 1).

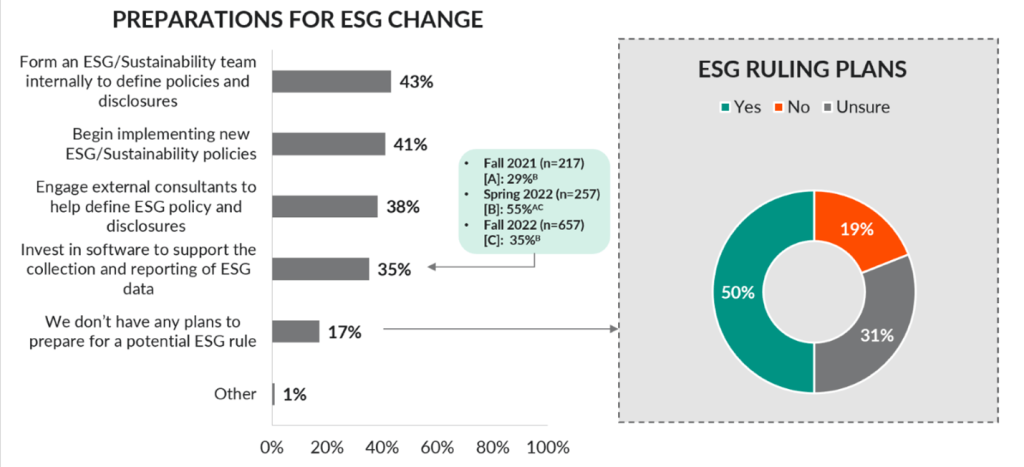

Regarding plans to prepare for changing ESG reporting requirements, just under half of financial executives surveyed have already started or plan to start forming an internal ESG/Sustainability team to define policies and disclosures. A similar proportion (41%) will begin (or have already begun) implementing new ESG/sustainability policies. Compared to the Spring 2022 survey, fewer are planning to invest in software to support ESG data collection and reporting. Among those who currently don’t have a plan in place, half (50%) indicate they may implement a plan if ESG reporting mandates impact their organizations (see Figure 2).

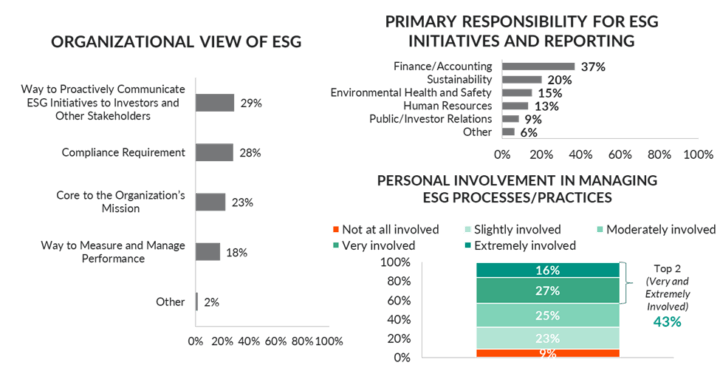

Organizational views of and financial leaders’ involvement in ESG initiatives vary, based on the survey. Only a quarter (23%) view ESG as being core to the organizational mission. Meanwhile, almost one-third view ESG as either a way to proactively communicate initiatives to investors and stakeholders (29%) or a compliance requirement (28%).

Although Finance/Accounting departments are most commonly responsible for ESG initiatives and reporting, this assignment of responsibility is still only the case for about two in five businesses (37%). Similarly, less than half (43%) of the financial leaders themselves are highly involved in managing the ESG process or practices (see Figure 3).

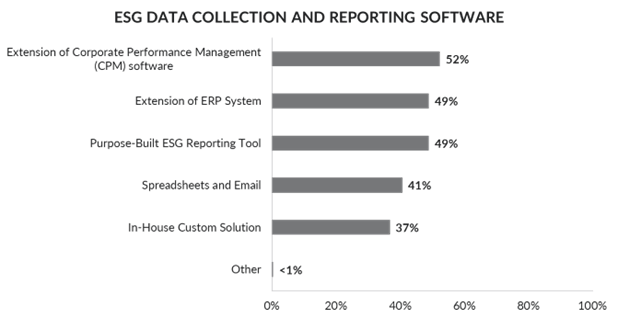

When financial decision-makers were asked about what type of software is currently being used or planned to be used to support ESG reporting, extensions of CPM software were reported as the most cited software for supporting the collection and reporting of ESG data. Extensions of ERP systems and purpose-built ESG reporting tools are also both cited by half of organizations (49% each) (see Figure 4).

Summary

The mandatory ESG disclosures being proposed by the US SEC & European Union are driving many organizations to invest in their ESG processes and software. Those investments will help with not only reporting compliance, but also planning and managing ESG initiatives. And there’s more good news – today’s cloud-based CPM and analytical software technologies are seeing increased adoption and proving their worth. How? By helping Finance teams become more efficient effectively plan and navigate the volatile economic landscape, which increases Finance’s agility to respond.

Learn More

To learn more, read the detailed survey report and visit our website at www.onestream.com. Need help conquering the complexities of ESG reporting in the current economic landscape? Contact OneStream today!