This article first appeared on OneStream Software blog page by Zach McKeown

However, the undeniable reality is that organizations now find themselves at a critical juncture – either embrace unified connected planning or risk incurring hidden costs.

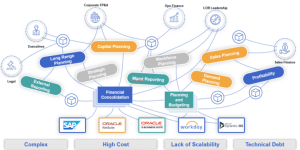

In the world of corporate performance management (CPM), modeling and planning toolkits such as Anaplan, Board and Essbase have been celebrated for their flexibility and speed in addressing departmental planning needs. However, a critical issue arises when these toolkits are tasked with unifying planning processes across an entire enterprise. The fundamental problem lies in the approach employed by FP&A teams, as the toolkits rely on individual planning models that must be interconnected.

That reliance on disconnected models introduces data latency, risks and chaos. The result? A planning process that’s cumbersome, challenging to access, slow to consolidate and prone to inconsistencies. Moreover, the reliance on disconnected models also often leads to user errors and incurs substantial data movement costs (see Figure #1).

Understanding the root of this chaos requires recognizing that these disconnected models primarily serve three purposes:

- Ensuring Consistent Data Collection: The models are often used to maintain data consistency.

- Aggregating Disconnected Data: The models are employed to aggregate data from various sources and systems.

- Inputting Data for Analysis: The data is input into another planning model for in-depth analysis.

The drawback of using disconnected models is the significant amount of time and effort invested in creating and maintaining them. Exacerbating the issue, the models are frequently misused, leading to additional time spent on fixing and consolidating data.

The Hidden Costs FP&A Modeling Toolkits

In today’s corporate landscape, FP&A leaders have a newfound influence, empowered by technological innovations to shift the focus from static back-office tasks to delivering timely, accurate financial and operational insights across the enterprise. However, when contemplating investments to unify connected planning, Finance-oriented CFOs and leaders must consider the common attributes and hidden costs associated with modeling toolkits:

- Data Hubs Created Due to Lack of a Unified Platform: The absence of a unified platform necessitates the creation of data hubs, introducing complexity.

- Endless Design Possibilities and Flexibility: While attractive, flexibility often results in ongoing costs and the need for continuous fixes.

- Data Inconsistencies and Validation: Continuous effort is required to validate data across connected models.

- IT Expenses for ETL and Data Synchronization: Technical deficiencies necessitate significant effort and IT expenses for Extract/Transform/Load (ETL), synchronized models and data repositories.

- Multiple Environments and Data Movements: The need for multiple environments and data movements increases third-party app and data integration costs.

- Monitoring and Repairing Connections: Substantial funds are allocated to monitor and repair the connections between models.

While modeling toolkits are effective for departmental needs, the widespread use of these toolkits across the enterprise planning process generates hidden costs that cannot be ignored (see Figure #2).

Hidden Costs to Consider for Unifying Connected Planning

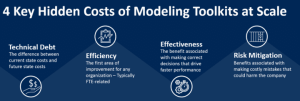

For FP&A teams aiming to unify their connected planning processes using modeling toolkits, below are four hidden costs that must be considered:

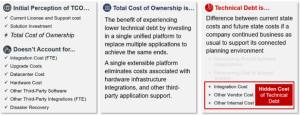

Hidden Cost #1: Technical Debt Is More Than Total Cost of Ownership (TCO)

Scaling connected planning with modeling toolkits often focuses solely on the return on investment (ROI), overlooking the burden of technical debt. Yet implementing a new entity or structure within the organization frequently requires rebuilding modeling toolkits, leading to increased technical debt and higher overall costs (see Figure #3).

Key TCO Consideration

- A good example scenario is an organization that has acquired a new entity that requires tasking the FP&A team with folding the new structure into the current Chart of Accounts (COA). Regardless of complexity, this daunting task will require modeling toolkits – such as Anaplan, Essbase, Oracle Analytics Cloud (OAC) and IBM TM1 cubes – to be either partially or entirely rebuilt. Doing so requires spending time to define and implement the new solution, which will include new data integrations, a new data hub or data warehouse, a new COA, new calculations and new reports.

- The organization may gain some additional insights from implementing a connected planning solution using modeling toolkits, but there would be no reduction in technical debt. In fact, technical debt is more likely to increase and then get labeled as simply the cost of doing business

Hidden Cost #2: Short-Term Gains Erode Organizational Efficiencies

While modeling toolkits offer short-term gains by automating manual processes, using the toolkits can lead to near-term losses for large organizations. These toolkits, despite efforts to connect toolkits, remain fragmented systems that lack scalability, posing a risk to organizational performance.

Key Efficiency Consideration:

- Fragmented Software & Processes – Connected but non-unified Finance solutions require fragmented cubes, modules and sometimes software to support diverse planning processes (e.g., S&OP, sales planning and long-range planning) and offer no solution for insights beyond Finance.

Hidden Cost #3: Forfeiting Effectiveness Is Not an Option

While efficiency gains are enticing, forfeiting effectiveness for the sake of efficiency can be counterproductive. The fragmented nature of modeling toolkits often results in efficient work being applied to inaccurate data, increasing costs as teams seek correct information.

Key Effectiveness Consideration:

- More Data Management & Administration – Non-unified connected planning solutions add technical complexity and administrative burdens on the Finance team – such as moving and reconciling data, constantly managing metadata, monitoring data latency, and managing security between fragmented applications and models. Collectively, these burdens dilute the ability of strategic Finance teams to focus on driving performance and supporting critical decision-making.

Hidden Cost #4: Poor Collaboration Increases Organizational Risks

Collaboration breakdowns related to disconnected data sets can lead to costly mistakes. Only a unified platform can effectively mitigate these risks by ensuring seamless collaboration among departments and applications.

Key Risk Mitigation Consideration:

- Lack of Financial Intelligence – Most modeling toolkits provide no pre-built financial intelligence. What does that mean? It means all the core “financial logic” for monthly financial processes – such as debit/credit account types, hierarchies, dimensionality and currency translation – must be built completely from scratch, which exposes the organization to risk and costs.

Conclusion

Modeling toolkits, despite their merits, also come with hidden costs and complexities that can hinder enterprise-wide planning and performance. FP&A leaders must carefully weigh these factors when considering the adoption of modeling toolkits for connected planning and explore more unified solutions to optimize financial and operational insights across the organization.

Learn More

To learn more about how organizations are scaling connected planning, click here to read our whitepaper on the topic. And if you’re ready to take the leap from spreadsheets or legacy CPM solutions and start your Finance Transformation, let’s chat!